Musk’s next orbit could pull AI into a new gravity well

The potential IPO of SpaceX, which several reports say could land in mid-June, has reignited the debate over how space technology and artificial intelligence now move markets together. The deal, which aims for a valuation near 1.5 trillion dollars and could raise tens of billions, would be the largest in Elon Musk’s group and one of the decade’s most consequential tech listings. The signal to investors is clear: assets with proven execution, global operating networks, and a clear plan to scale data and compute infrastructure command premium valuations even in a more selective capital environment.

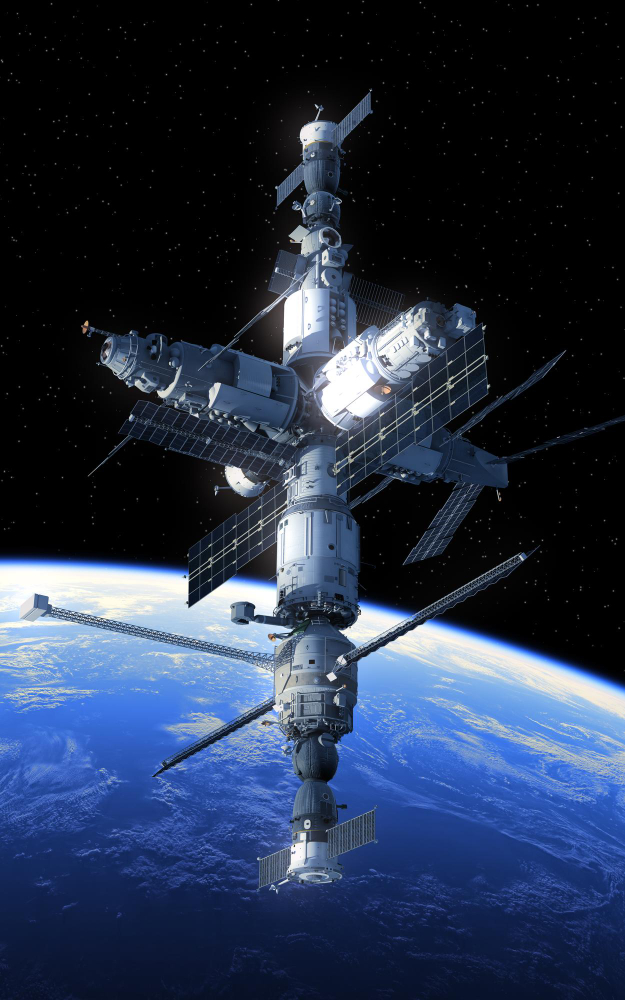

The appeal is not only about launch cadence or leadership in reusable rockets. The thesis sits at the intersection of an orbital platform, satellite services, and artificial intelligence. For industrial customers and governments, combining low-latency connectivity with near real-time analytics unlocks critical use cases such as supply chain monitoring, earth observation with event detection models, and coordination of distributed fleets. With that logic, each new Starlink generation adds more than network capacity. It broadens the surface for data services and AI agents that run closer to the user or device.

Are you looking for developers?

Recent figures help frame the moment. Financial reporting points to an offering that could target up to 50 billion dollars, backed by global banks and a preparation process the company accelerated since late 2025. The stated goal is to capture revenue momentum and translate it into investment capacity for the next growth phase, while keeping an operating structure that can fund capital-intensive programs and long R&D cycles without losing discipline. For markets, a valuation reference around 1.5 trillion dollars and private transactions that placed the group near 800 billion serve as anchors for expectations.

Beyond the headline, the enterprise narrative is shaped by the rapid adoption of AI in everyday operations. In logistics, prediction models optimize routes and loading windows. In energy, automated agents coordinate maintenance and manage capacity. In digital services, intelligent assistants reduce latency and personalize experiences with measurable impact. These capabilities require a strong data foundation, clear residency policies, observability by design, and deployment routes that combine cloud, edge, and dedicated infrastructure. The advantage does not come from a single model. It comes from the full system that turns distributed signals into actionable decisions.

If SpaceX’s IPO proceeds on the suggested terms, it would also act as a barometer for AI infrastructure financing. Large data centers and interconnection networks need energy contracts, dependable supply of specialized hardware, and architectures that support centralized training and distributed inference. In that landscape, operators who can integrate satellite connectivity with terrestrial networks and orchestration software have an edge. The investor question is not whether demand exists, but which players can convert that demand into durable margins with solid governance and public metrics for availability and efficiency.

Are you looking for developers?

For companies building on these platforms, the challenge is turning AI ambition into operational outcomes. That is where execution-focused technical partners make a difference. Square Codex operates on that frontier between strategy and delivery. Based in Costa Rica, the firm works under a nearshore staff augmentation model, embedding software engineers, data specialists, and AI teams inside North American organizations. The engagement starts with architecture: governed data catalogs, dependable APIs, role-based access controls, and model routing mechanisms that balance cost, latency, and quality. The aim is for AI use cases to launch with traceability and meet security and compliance requirements without slowing the business.

Square Codex continues to add value once systems are live. Its teams implement MLOps and observability practices that distinguish whether a deviation comes from the model, the data source, or the integration layer. They configure automated quality checks, performance thresholds, and safe degradation paths to preserve service continuity during demand spikes or provider changes. In organizations deploying capabilities over global networks and operating under strict latency targets, this discipline reduces rework and speeds the shift from pilots to stable operations, with cost-per-interaction and availability metrics aligned to financial goals.

The lesson from today’s market is straightforward. AI has moved from promise to systems that run under demanding contracts and real audits. Leaders who align connectivity, compute, and software with governance and control are better positioned to capture sustained value. A SpaceX listing in the proposed range and timeline would reinforce that view by showing investors are willing to fund platforms that convert infrastructure into measurable, scalable services with high barriers to entry. The rest of the sector will take note, since competition now turns less on raw technical capability and more on how consistently that capability shows up in quarterly results.

Are you looking for developers?

For executive teams, the practical path runs on three fronts: clean up data and its governance, choose architectures that allow model and vendor flexibility without rebuilding everything, and set metrics that tie technical performance to business impact. On that ground, specialized support from partners like Square Codex helps narrow the gap between intent and execution. The next wave of value will not come from announcements. It will come from operations that run without friction and convert every incremental improvement into cumulative advantage.

In short, if the IPO materializes, it will mark a reference point for financing critical AI infrastructure and for the companies that depend on it. Capital will follow those who can scale with control, integrate complex systems, and deliver measurable outcomes. That is the yardstick by which the next generation of tech champions will be judged. News cycles will keep adding details, but the underlying story is already clear: artificial intelligence is only as strong as the operation that sustains it.