AI Boom Supercharges Chipmaking Tools to $126B by 2026

The growth of the semiconductor manufacturing equipment market is keeping pace with the demands of artificial intelligence. This is not only about producing more chips to train or run models, but about direct pressure on fabs, production processes and suppliers of highly specialized machinery. Forecasts put manufacturing tool sales at around 126 billion dollars by 2026, a figure that reflects the necessary expansion in advanced logic and memory, as well as the push to build more resilient supply chains. Behind that number are sustained investments in extreme lithography, high-precision metrology and advanced packaging technologies that are essential to deliver performance, energy efficiency and large-scale availability.

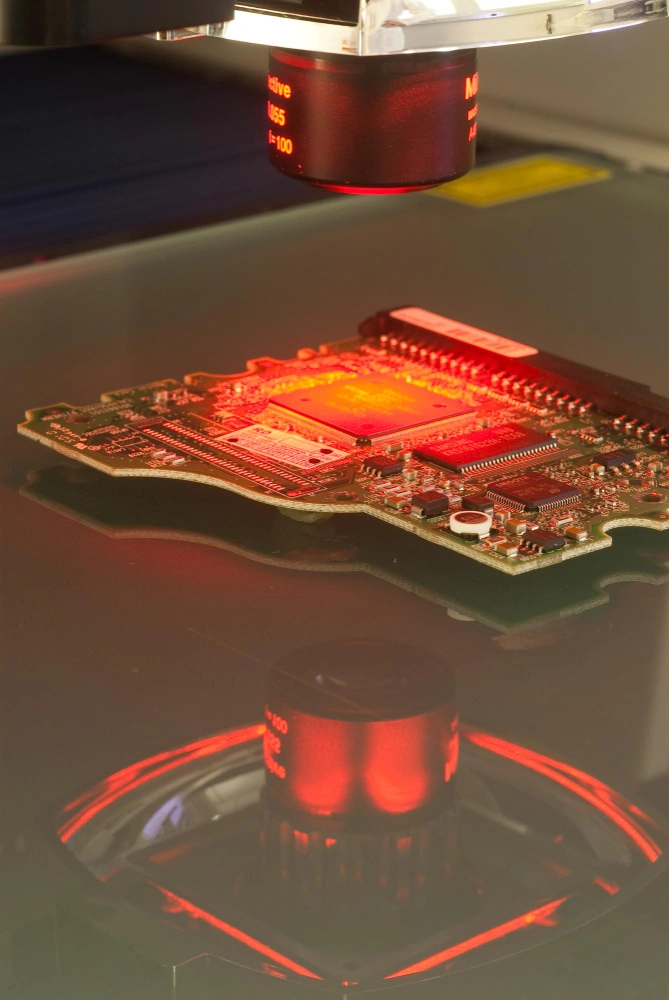

AI-driven demand starts at the base of the system. Ever more complex models and increasingly pervasive digital services require smaller process nodes and memory capable of moving large volumes of data with minimal latency. This forces capacity expansions below five nanometers, accelerates EUV adoption and reinforces inspection and defect-control systems. At the same time, the rise of high-bandwidth memory pushes HBM output and the refinement of 3D stacking and high-density interconnects. The result is an investment cycle that goes well beyond software and turns into critical decisions inside the fab, where each wafer touches more tools, more steps and tighter control requirements.

Are you looking for developers?

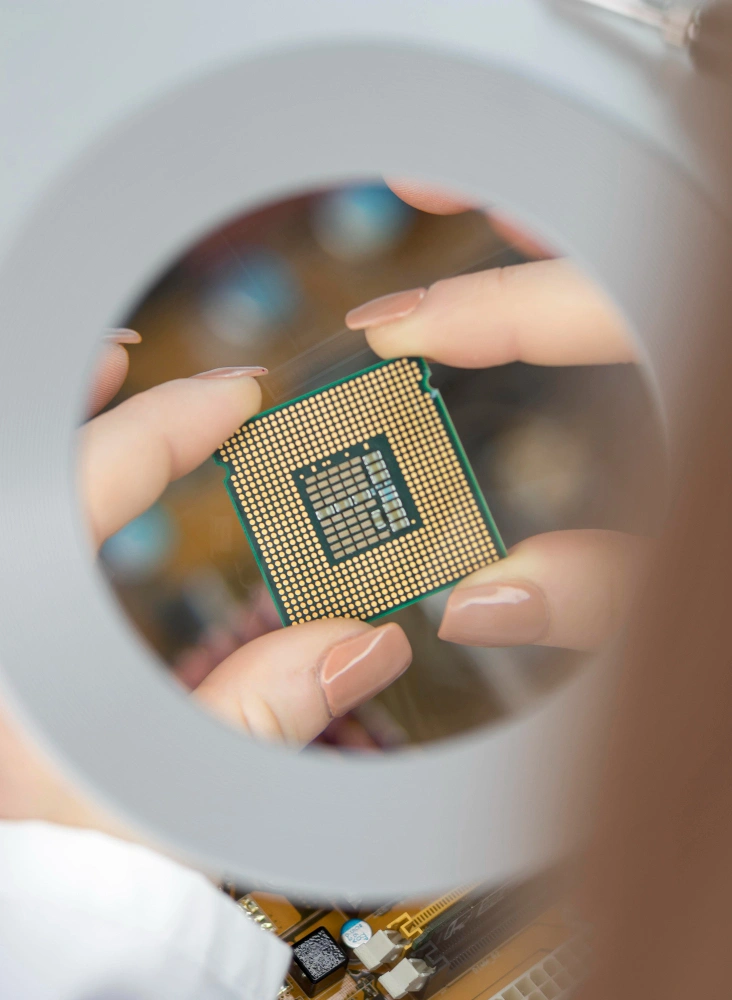

In this context, the major equipment makers become central. ASML dominates EUV lithography, Applied Materials and Lam Research are key in deposition and etch, KLA leads inspection and metrology, and Tokyo Electron fields a broad front-end portfolio. This concentration speeds process maturity, but it also introduces risk. Fabs depend on delivery schedules, spare parts and service with long lead times. Planning is no longer only about capex; it now includes service capacity management, specialized personnel and continuous maintenance to avoid downtime in an environment where any stop carries a high cost.

Regionalization adds complexity. The United States, Europe and several Asian economies have rolled out incentives to attract local capacity, while China, Taiwan and South Korea maintain their weight as manufacturing hubs. Geopolitical tensions and trade restrictions are pushing diversification of sites and suppliers. The result is a more distributed network with differing regulatory frameworks, cost structures and energy conditions that influence the final cost per wafer. Striking the balance between proximity to market, supply security and scale efficiency will decide which projects reach maturity and which remain press releases.

Making ever more advanced chips means accepting that each incremental improvement raises costs. Shrinking geometries requires more complex masks, finer treatments and longer production cycles. Manufacturers need tools that keep variability under control, with real-time measurements and analytics that detect deviations before they affect large volumes. Advanced packaging is becoming as strategic as front end, with 2.5D and 3D solutions that bring logic and memory closer to maximize bandwidth and reduce power. Environmental pressure is also rising, since manufacturing is intensive in energy and water, and efficiency targets are entering contracts, audits and public reports.

Are you looking for developers?

Government incentives lower the initial barrier, but they do not replace rigorous execution. The plants that capture the best returns will be the ones that can integrate equipment from different suppliers, stabilize yield, deploy predictive maintenance and standardize processes as volume grows. Operational discipline will be as decisive as the technical capabilities of the machines. So will talent, a resource that is increasingly scarce in regions seeking to expand capacity without yet having a mature industrial ecosystem.

Asia will remain the sector’s core. China is strengthening its production base with an eye on resilience, Taiwan keeps its leadership in cutting-edge logic, and South Korea is accelerating in memory and advanced packaging. This concentration does not prevent other regions from growing, but it underscores that the learning curve in semiconductors is long and costly. Equipment vendors that enable process transfers across sites and provide local service with guaranteed response times will have an edge in a cycle where availability is part of the value proposition.

For equipment buyers, the decision no longer stops at price and specifications. Supply chain strength, energy consumption, support capacity and compatibility with medium-term product roadmaps all come into play. AI also shifts demand over time. Training peaks favor the most advanced logic, while the expansion of inference pushes memory and packaging that sustain volume at controlled cost. The ability to reweight investments without eroding margins will be a differentiator.

Are you looking for developers?

Ultimately, execution and talent tie all of this together. Without teams able to translate technology plans into stable processes, investment in machinery will not turn into yield or competitive unit costs. Continuous training, retention and close collaboration with tool and materials suppliers are constant tasks. Companies that manage the fab-technology-people triangle well will be the ones that convert the AI boom into sustainable contracts and a solid position when the cycle becomes more selective.

It is worth remembering that this transformation does not happen in a silo. AI is reshaping the entire chain, from the application layer to the factory floor. The 126 billion projected for 2026 is not just a striking number, it is the reflection of a production system reorganizing to deliver specialized computing at scale. The sector’s next chapter will be written by those who combine disciplined investment, operational excellence and the ability to operate in an increasingly demanding geopolitical and energy environment.

In that setting, many companies building software, data and AI solutions need to strengthen delivery capacity while the hardware ecosystem expands. Square Codex, headquartered in Costa Rica, works under a staff augmentation model that integrates software engineers, data specialists and AI teams within North American organizations. The focus is practical and results-oriented: helping scale technology initiatives, sustaining operations as projects move from pilot to production, and ensuring that technology investments translate into real operational value.